Real estate investment is a proven path to wealth-building and financial security. This article explores the essentials of real estate investing, offering insights into its benefits, strategies, and steps to help you succeed in this dynamic industry.

What is Real Estate Investment?

Real estate investment involves purchasing, managing, or profiting from properties, including residential, commercial, or industrial assets. It offers multiple income streams, such as rental earnings, property appreciation, and tax benefits, making it a popular choice among investors.

Benefits of Real Estate Investment

- Steady Income: Rental properties can provide consistent cash flow.

- Appreciation: Property values typically increase over time, offering long-term gains.

- Diversification: Adding real estate to your portfolio reduces overall investment risk.

- Tangible Asset: Unlike stocks or bonds, real estate is a physical asset you can manage directly.

For guidance on real estate investment tailored to your goals, visit 10for10.uk.

Types of Real Estate Investments

1. Residential Real Estate

Properties like single-family homes, apartments, and vacation rentals are beginner-friendly and yield steady rental income.

2. Commercial Real Estate

Includes office spaces, retail shops, and warehouses. These investments typically provide higher returns but require more significant capital and expertise.

3. Industrial Real Estate

Properties like factories and storage facilities generate income through long-term leases.

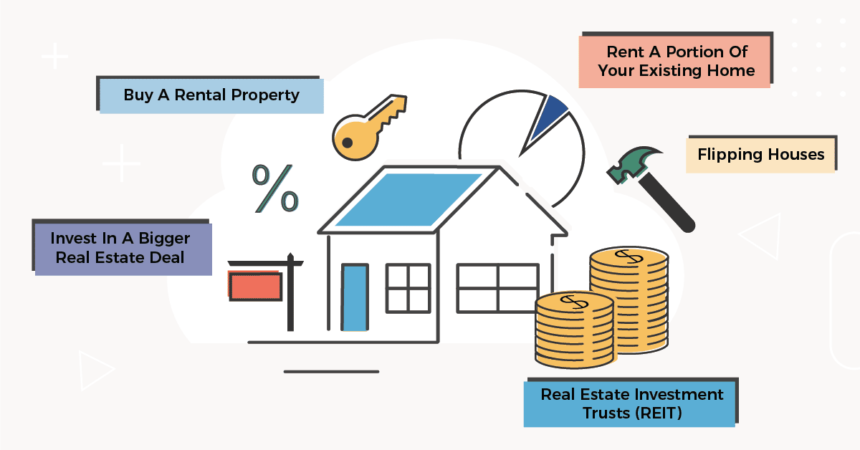

4. REITs (Real Estate Investment Trusts)

A passive way to invest in real estate, allowing investors to earn dividends without owning physical property.

Key Real Estate Investment Strategies

- Buy and Hold: Purchase properties, rent them out, and sell later when their value appreciates.

- Fix and Flip: Buy undervalued properties, renovate them, and sell for a profit.

- Short-Term Rentals: Use platforms like Airbnb to rent properties to travelers.

- Commercial Leasing: Lease office spaces or retail units to businesses for consistent revenue.

Steps to Start Investing in Real Estate

1. Define Your Goals

Determine whether you aim for rental income, portfolio diversification, or long-term gains.

2. Research the Market

Analyze local property values, rental demand, and economic trends.

3. Secure Financing

Explore funding options such as traditional loans, partnerships, or private lenders.

4. Choose the Right Property

Assess factors like location, property condition, and potential returns.

5. Manage Your Investment

Decide whether to handle property management yourself or hire professionals.

For professional assistance, visit EverRise Brokers.

Risks in Real Estate Investment

- Market Volatility: Economic downturns can affect property values.

- Vacancy Periods: Prolonged vacancies reduce rental income.

- Unexpected Costs: Repairs, maintenance, and legal issues can arise.

- High Initial Capital: Real estate often requires a substantial upfront investment.

Emerging Trends in Real Estate

1. Eco-Friendly Developments

Green buildings are becoming increasingly popular among tenants and investors.

2. Remote Work Influence

Suburban properties are in demand as remote work continues to grow.

3. Co-Living Spaces

Shared housing models are gaining traction in urban areas.

Conclusion

Real estate investment offers opportunities for wealth-building, but success requires strategic planning, market knowledge, and effective management. Platforms like 10for10.uk and EverRise Brokers can provide the support and expertise you need to achieve your financial goals.

Begin your journey today and make real estate a cornerstone of your investment portfolio.